Use PayPal Much? Don’t Become the Victim and Fall For These Paypal Scams!

On the whole, PayPal provides a great service in safely transferring money online. It is simple and secure and comes with many checks and balances to help protect users. Nonetheless, given its popularity, scammers aggressively utilize the platform’s name in their criminal activity. In this article, we’ll provide a run-down on common PayPal scams, how they work and what you can do to avoid being a victim.

Common Examples

1. PayPal Account Problems

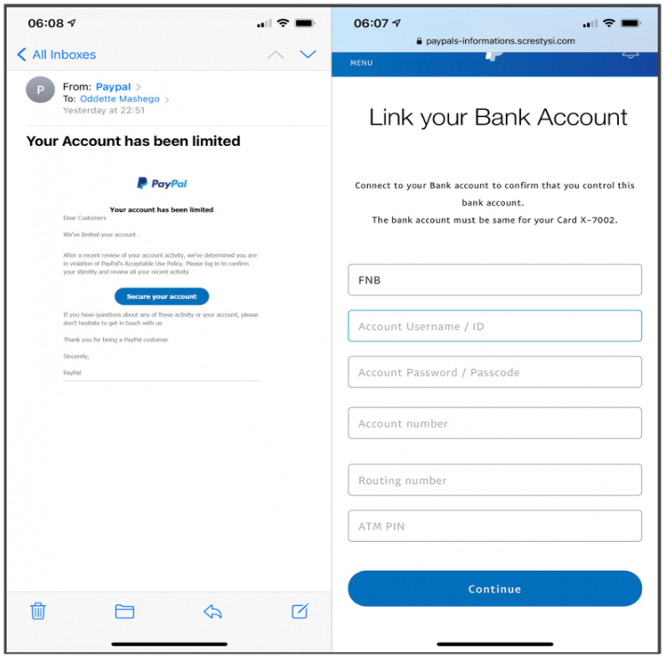

This is perhaps the most common scam. Scammers get in touch via email to “inform you” that there is a problem with your account. In the email there will be links which you are instructed to follow in order to resolve the issue. These are phishing links, the aim being to get you to enter personal information on the criminal’s fake log-in webpage. See below example.

PayPal email scam and fake PayPal login page. Source: Twitter

Text: Your account has been limited

Dear Customers We’ve limited your account. After a recent review of your account activity, we’ve determined you are in violation of PayPal’s Acceptable Use Policy. Please log in to confirm your identity and review all your recent activity

Secure your account

If you have questions about any of these activity or your account, please don’t hesitate to get in touch with us. Thank you for being a PayPal customer

Sincerely, PayPal

2. Advance Payment Fraud

This is another common PayPal scam. In it, victims will receive the miraculous news that they are owed an amount of money: inheritance, lottery, compensation etc. The victim will be asked to make a small advance processing payment (using PayPal) and perhaps fill out a form with their personal data.

If you are unlucky and/or inexperienced enough to fall for this, the sender disappears upon payment, and any personal data you shared will end up on a database — most likely on the dark web.

3. Overpayment Refund

This one is more humanly complex than the above — and particularly crafty. In this scam, a buyer sends a seller (you) the payment for goods. However, they send more than the sale price. The buyer points to the “accident” and asks for a refund of the difference.

As soon as the seller/you do so however, the buyer/scammer immediately cancel the original transaction — thus making a profit with the difference you refunded.

4. Fake Charities and Investment Schemes

This horrible scam involves malicious requests sent out asking for donations to a fake charity. Often it will be requested via PayPal. Canceling the payment is no help if the scammer can withdraw the funds promptly —so you will need to check in advance. These schemes increase in frequency during/after a natural disaster.

Similar is the investment opportunity, seducing with promises of great risk-free profits. Again, the investment will be paid via PayPal.

Steps to Take

The following are some useful guidelines to help protect yourself:

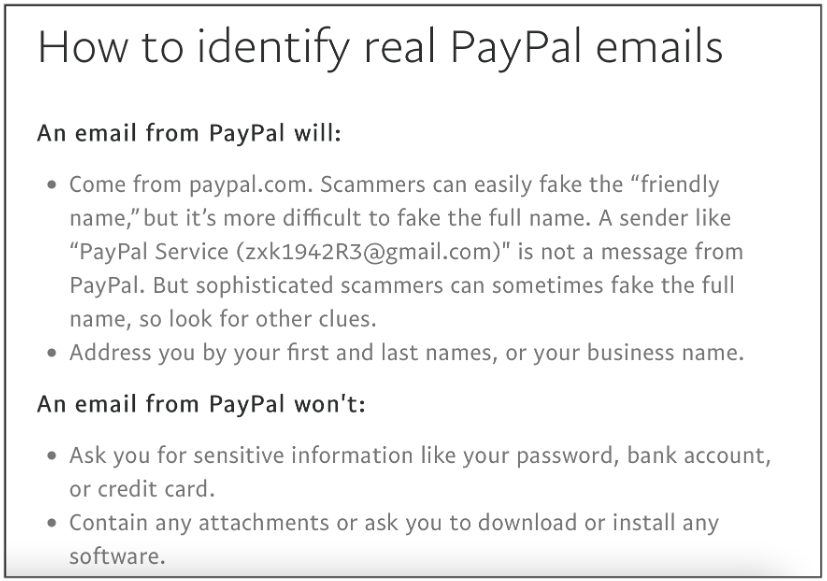

- Always pay attention to the sender email addresses.

Source: PayPal

- If you are offered free money, there WILL be a catch.

- If there is a problem with a transaction when using PayPal, it’s better to cancel the whole thing and start afresh.

- In regard to charities, always do your research into the body. These are good links: Charity Navigator& Charity Watch.

- Keep an out for tell-tale signs: grammatical mistakes, grand claims, exclamation marks (!).

- You can also report fake emails to PayPal directly to help more people:

1. Visit the PayPal Resolution Centre

2. Click Report a Problem.

3. Select the transaction ID you want to dispute and click Continue.

4. Select I want to report unauthorized activity.

5. Follow the instructions to report the issue.

- We would also recommend a cybersecurity product such as Trend Micro Check which is designed to combat things such as disinformation and scam emails.

So to summarize, keep your eyes peeled for these PayPal scam attempts! And if you’ve found this article a useful and/or interesting read, please do SHARE with family and friends to help keep loved ones secure and protected.